Both countries are gaining importance as export hubs in the global tech market.

Historically, the leading tech export hubs were in the United States, some European countries, and China. However, international trade dynamics are constantly evolving. Recently, export shipment requests have increased in the Netherlands and Singapore. This is no coincidence: both countries are positioning themselves as strategic centers due to their location, productive structure, and favorable policies for technological development. To better understand the export boom in Netherlands and Singapore, Aerodoc provides a detailed analysis of some key factors driving this phenomenon.

A Favorable Context

The International Monetary Fund (IMF) projects global economic growth at 3.2% in 2024. The World Trade Organization (WTO) also expects global merchandise trade to rise by 2.6%. These favorable projections support the emergence of new influential players in international trade. In this scenario, a combination of strategic factors makes the Netherlands and Singapore stand out as export origins, especially in the tech sector.

The Netherlands as an Export Hub

In 2023, the Netherlands exported €945 billion in goods and services. Goods exports make up 63% of the country’s GDP, while the total of goods and services accounts for nearly 89% of GDP. This places the Netherlands as the second-largest goods exporter in the European Union after Germany.

The following are some reasons behind its growth:

High-Tech Production

The increase in exports from the Netherlands is due to its advanced high-tech industry, a market valued at €65.6 billion in 2023. The country excels in sectors like electronics, semiconductors, and artificial intelligence. Dutch companies such as ASML, a global leader in chip-making machinery, have consolidated their presence worldwide.

ASML is the only company in the world producing advanced lithography machines, particularly extreme ultraviolet (EUV) lithography machines, essential for making the most advanced AI chips. In this regard, the Netherlands plays a crucial role in the trade war between the U.S. and China over semiconductor production, a market projected to generate $624 billion in revenue by 2024.

Supportive Policies

The Dutch government implements export promotion programs such as the Dutch Trade and Investment Fund (DTIF), which provides financing and insurance to companies looking to expand; the Innovation Credit Program, which offers loans to startups with high export potential; and Partners for International Business (PIB), which fosters cooperation between government, industry, and universities to enter foreign markets.

Infrastructure and Trade Connections

As part of the European Union, the Netherlands benefits from multilateral agreements that facilitate market access with no tariffs or reduced costs. The Port of Rotterdam and Amsterdam Schiphol Airport are global logistics hubs for high-value goods and serve as gateways for European products to the rest of the world.

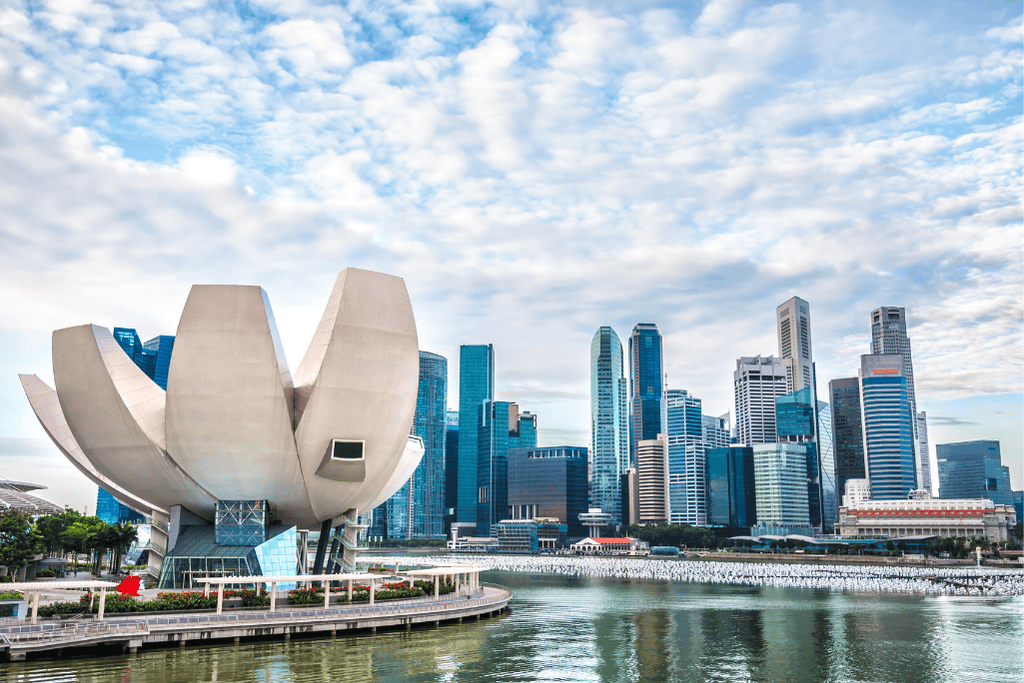

The Rise of Singapore as an Export Powerhouse

Singapore’s economy grew 2.7% year-on-year in the first quarter of 2024, with its GDP expected to increase between 1% and 3% for the year. In 2023, the country’s exports of goods amounted to $475 billion, with electronics, integrated circuits, and technology-related machinery representing 34% of that total, valued at $161 billion.

Amid Southeast Asia’s growth in recent years (the region accounts for 8% of global exports and

attracts 10% of foreign direct investment), Singapore, a small but densely populated country, is

emerging as a key hub for trade and production. The city-state serves as the gateway to the region,

representing two-thirds of Asia’s total venture capital funding and hosting half of the multinational

corporations in the area. In addition, it is home to 4,000 tech startups.

A report on Singapore’s tech exports highlights the critical role of electronics, such as consumer devices and AI servers. Projections indicate a growth in key exports of 4% to 6% in 2024.

The following factors contribute to Singapore’s growth:

Digital Economy

The Singapore Digital Economy Report 2023 highlights the significant development of the country’s digital economy, which now represents 17.3% of its GDP. This digitalization has been driven by government policies, such as the Digital Transformation Program, which provides subsidies and technical assistance to businesses for adopting digital solutions; Enterprise Singapore, a state agency supporting local companies in expanding internationally; and the Smart Nation Initiative, which integrates digital technology into all aspects of society.

Focus on AI

Singapore has seen a boom in semiconductor and IT production. With an attractive business environment and a focus on innovation, companies such as TSMC, STMicroelectronics, Broadcom, Micron Technology, and Singtel have significant operations in the Asian country. Additionally, the national program AI Singapore seeks to boost artificial intelligence research and establish favorable regulations for its development.

Strategic Location and a Favorable Business Climate

Singapore has strong links to major markets in the Asia-Pacific region. Its commercial infrastructure and highly skilled workforce attract 80 of the world’s top 100 tech companies, which remain in the country.

Meeting Market Changes

When facing market shifts, partnering with an international logistics company with over 25 years of experience can be the key to expanding your project into new countries without any setbacks. “With international hubs in today’s most strategic points, Aerodoc is well-prepared for the dynamic tech market,” highlights Estefanía Sisatzky, Senior VP of OPS & Customer Service at Aerodoc. Our comprehensive logistics service allows us to handle international shipments from any country.

Contact our team of experts to learn more about Aerodoc’s services.

Q&A

Why has the Netherlands become a key tech hub?

The Netherlands stands out as a technology export hub thanks to its advanced infrastructure, innovation-supporting policies, and growing high-tech sector. Companies like ASML, a global leader in chip-making machinery, have established the country as a key player in the semiconductor and advanced technology markets. In 2023, the Netherlands exported €945 billion worth of goods and services, boosting its economy significantly.

What factors have driven Singapore’s rise as a major tech exporter?

Singapore has experienced growth in tech exports due to its strong focus on the digital economy and artificial intelligence. In 2023, tech-related goods made up 34% of the country’s total exports, led by sectors like integrated circuits and technology-related machinery. Additionally, the city-state offers a favorable business environment, attracting major tech companies and startups to establish operations there.

How do government policies impact the growth of tech exports?

Government policies are critical in boosting tech exports in both the Netherlands and Singapore. In the Netherlands, programs such as the Dutch Trade and Investment Fund (DTIF) and the Innovation Credit Program support companies in their international expansion efforts. Conversely, Singapore has implemented initiatives like the Digital Transformation Program and the Smart Nation Initiative, helping businesses adopt digital solutions and expand globally.

What tech products stand out in the exports from the Netherlands and Singapore?

In the Netherlands, semiconductors and advanced machinery, particularly those related to chip manufacturing, are the standout tech products. Singapore, in turn, focuses on electronic products such as integrated circuits and AI servers, which make up a significant portion of the country’s tech exports.

What is the future outlook for tech exports from Singapore and the Netherlands?

The future outlook for both countries is positive. In the Netherlands, the high-tech market is expected to continue growing, particularly in areas like artificial intelligence and semiconductors. In Singapore, key tech exports are projected to grow by 4% to 6% in 2024, with a strong focus on the digital economy and information technology.

To facilitate the international expansion of technology companies in markets such as the Netherlands and Singapore, comprehensive logistics solutions are essential. Aerodoc offers Importer of Record Services (IOR), as well as Warehousing and Fulfillment (WMS & Fulfillment) solutions, which simplify the process of entering new markets without the need to establish local legal entities. In addition, our Global Solutions span from equipment pick-up to final delivery, ensuring a smooth and efficient logistics experience in more than 170 countries.