Asia accounts for 38.7% of global exports and leads in electronics, automobiles, and semiconductors.

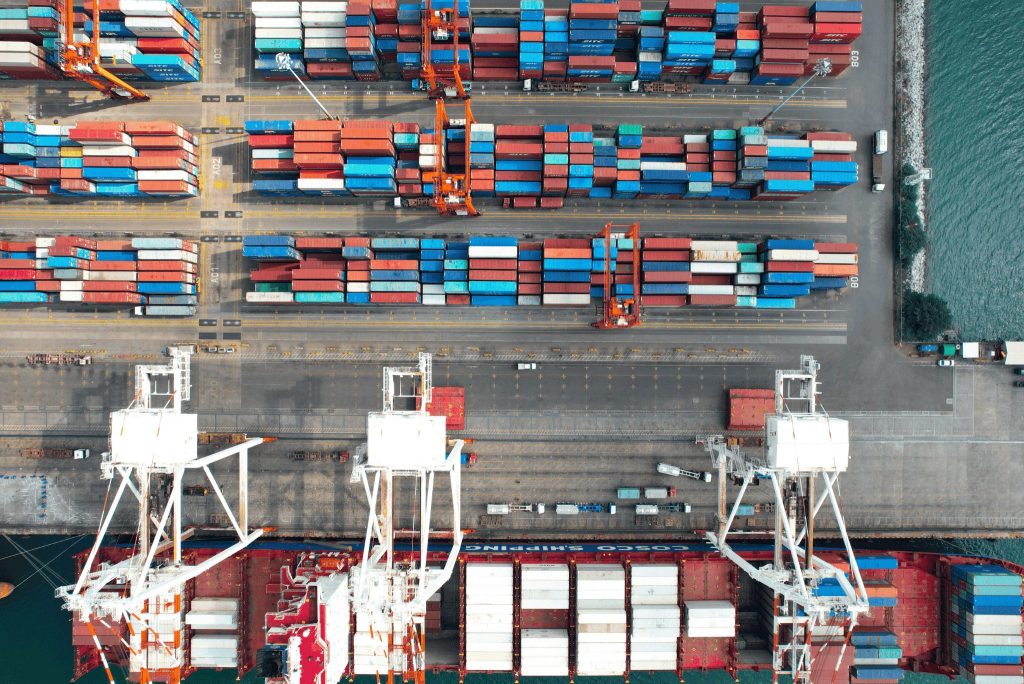

Asia is a major player in international commerce, recognized as a top producer and exporter across critical industries, including technology, electronics, and manufacturing. In 2023, the region’s trade represented 38.7% of global exports, driven by influential economies like China, South Korea, Taiwan, and Japan.

One of the region’s primary drivers is technological production, particularly audio devices, smartphones, robotics, antennas, microchips, semiconductors, and other information technologies.

Aerodoc offers a detailed analysis of Asia’s market potential, helping businesses looking to expand operations in this high-opportunity region understand key trade characteristics and strategic entry points.

Asia’s Potential as a Trade Leader

In 2023, Asia’s goods exports reached a staggering $17.6 trillion, a figure that only begins to capture its potential. According to the World Trade Organization (WTO), by the close of 2024, Asia’s export volumes will have grown faster than any other region, with an anticipated 7.4% increase.

China leads global exports, with $3.38 trillion in 2023, primarily directed to the United States, Hong Kong, Japan, and South Korea. Other expanding economies include India, which specializes in electronics and pharmaceuticals; South Korea, a leader in semiconductor innovation; and Japan, which is renowned for its robotics and automotive sectors.

Beyond technology, Asia’s exports span machinery, textiles, and consumer goods like fashion, cosmetics, and food. In finance, tourism, and services, cities such as Hong Kong, Singapore, and Tokyo are globally recognized hubs for industry and commerce.

Why Asia is an Export Powerhouse

Asia’s competitive edge in global tech exports is attributed to its robust production infrastructure, supportive economic climate, substantial investment, and progressive development policies.

Skilled and Accessible Workforce

Asia offers a vast and skilled labor force, with technical and scientific expertise at competitive wage levels. This workforce strength bolsters the industrial network, which supports numerous tech companies integral to the global supply chain.

Home to Leading Tech Giants

Asia is home to some of the world’s most significant technology companies, including Samsung, Huawei, TSMC, Xiaomi, Alibaba, Tencent, LG, and Sony. These companies produce advanced technologies and products that substantially contribute to global trade.

Strategic Research and Development Policies

Asian countries implement different government policies to attract investment and foster innovation. For instance, China’s “Made in China 2025” initiative provides tax incentives for high-tech sectors. Similar incentives are available in Singapore, Japan, and South Korea. Such investments make Asia a leader in high-demand products like robotics, semiconductors, and artificial intelligence.

Trade Alliances Driving Exports

Trade agreements that simplify export processes further improve Asia’s influence. For instance, the Regional Comprehensive Economic Partnership (RCEP) unites 15 Asia-Pacific countries, creating the world’s largest free trade area, representing 30% of global GDP. Other trade agreements, including the Association of Southeast Asian Nations (ASEAN) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), lower tariffs and trade barriers, fostering economic growth and job creation across the region.

Opportunities and Challenges for Entering Asia

With advanced transportation systems, Industry 4.0 innovations driven by 5G, digitalized customs procedures, first-class ports, and special economic zones, Asia provides a highly conducive environment for international trade. Growing consumption and economic expansion make this region a promising market for production and distribution across diverse product lines.

However, cultural and linguistic diversity challenges international companies looking to establish or expand operations. Additionally, customs regulations vary widely across countries, creating complex bureaucratic hurdles, particularly for tech imports—a factor that companies should not underestimate.

As part of our Global Trade Essentials service, Aerodoc has developed essential guides with vital information for companies planning to enter key Asian markets. The latest country profile can be downloaded here.

With over 25 years of experience in international tech logistics, import, and delivery, we’re ready to help you lead with the difficulties of global trade.

For further information on our services, contact our team of experts.

Q&A

What is Asia’s significance in international trade?

Asia is a major player in global trade, accounting for 38.7% of global exports in 2023. The region excels in key sectors such as technology, electronics, and manufacturing, driven by producing and exporting products like microchips, semiconductors, and audio devices. Leading countries include China, South Korea, Japan, and Taiwan.

What factors have positioned Asia as an export powerhouse?

A robust production structure, a favorable economic environment, investment in R&D, and progressive development policies support Asia’s growth in the tech sector. Programs like “Made in China 2025” incentivize tech companies by offering tax benefits. Additionally, countries like Singapore, Japan, and South Korea foster innovation through policies that support technological advancement.

Which are the major tech companies originating from Asia?

Asia is home to some of the world’s most influential technology companies, including Samsung, Huawei, TSMC, Xiaomi, Alibaba, Tencent, LG, and Sony. These companies produce a wide range of mass-market goods and advanced technologies essential for international trade, from semiconductors to artificial intelligence.

What role do trade agreements play in Asia’s growth as an export powerhouse?

Trade agreements like the Regional Comprehensive Economic Partnership (RCEP), which includes 15 Asia-Pacific countries, have been fundamental to Asia’s growth. RCEP forms the largest free trade zone globally, facilitating trade and strengthening regional economies. ASEAN and CPTPP promote commerce by reducing trade barriers and fostering job creation.

What are the key challenges for companies looking to expand into Asia?

Despite the opportunities, entering the Asian market presents challenges such as cultural and linguistic diversity, as well as customs regulations that vary from country to country. Customs bureaucracy, particularly for tech imports, can be complex and requires detailed expertise to navigate potential obstacles in import processes.