Incoterms CPT and CIP define the responsibilities of sellers and buyers in international trade contracts.

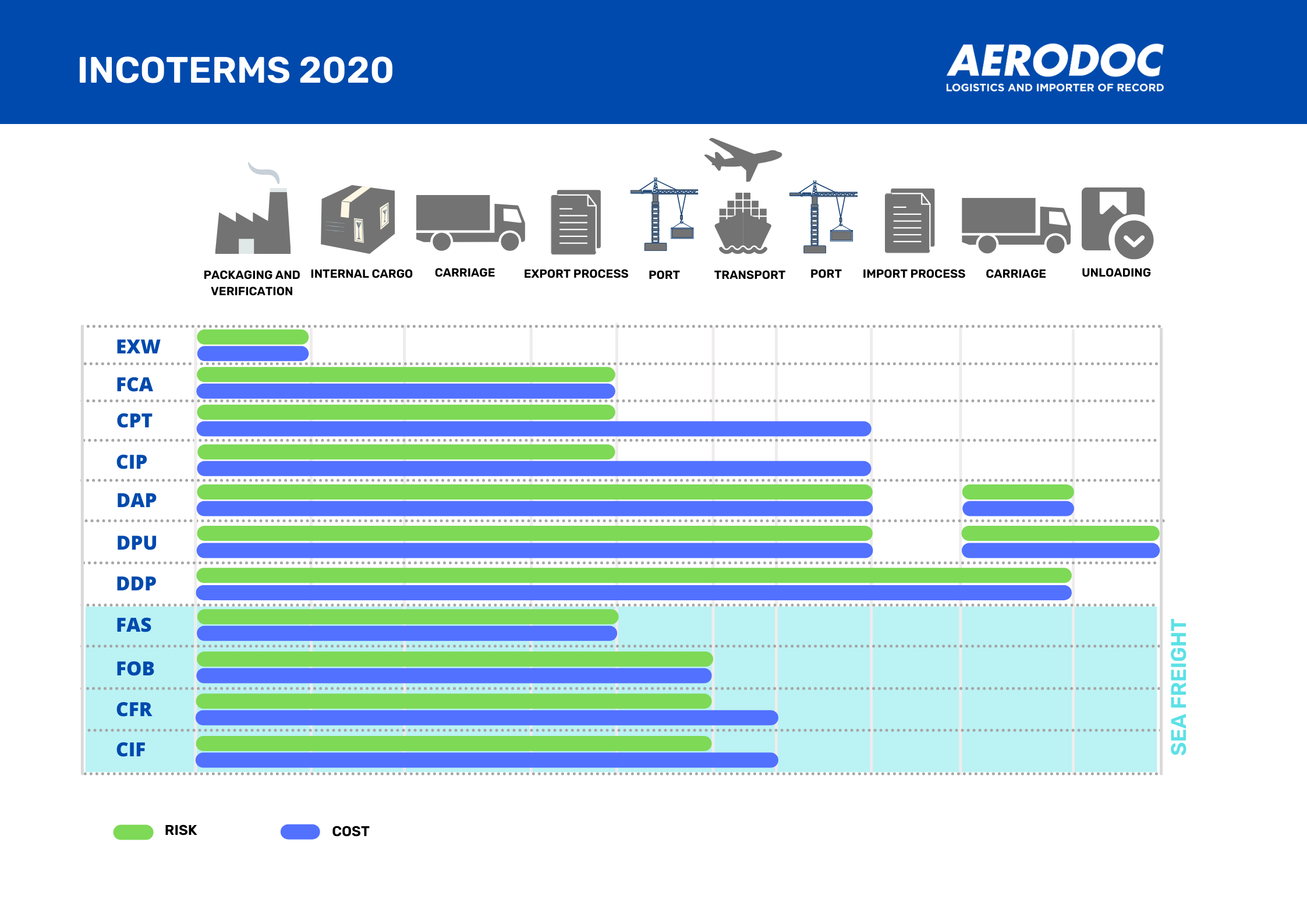

Incoterms are essential tools in international trade. They clarify the allocation of responsibilities between buyers and sellers. Among the most widely used terms are Carriage Paid To (CPT) and Carriage and Insurance Paid To (CIP). While these terms share similarities, they also exhibit notable differences that can impact a transaction’s financial and risk-related aspects.

Choosing between CPT and CIP incoterms can influence the initial costs and the level of protection afforded to goods during transit. What do these terms mean, and which is best suited for your business? The answer depends on factors such as the nature of the goods, the experience of the parties involved, and specific logistical conditions.

This article analyzes these Incoterms, highlighting their distinctive features and exploring how they shape strategic decision-making in international operations.

CPT vs. CIP: Key Features

Carriage Paid To (CPT) and Carriage and Insurance Paid To (CIP) require the seller to organize and cover the cost of transportation to the agreed destination. In both cases, the risk transfers to the buyer once the goods are handed over to the first carrier. These terms can be applied across several transportation modes, including air, sea, land, rail, and multimodal options.

Carriage Paid To (CPT)

Under CPT, the seller is responsible for arranging and paying for the shipment of goods to the designated destination. However, the buyer assumes all risks associated with the goods from when they are handed over to the carrier at origin.

For instance, if goods are exported under CPT, the seller coordinates and pays for transportation from the origin to the destination. In the event of an accident, damage, or loss during transit, the buyer is legally responsible for any associated costs or liabilities after the goods are handed over.

Carriage and Insurance Paid To (CIP)

Similarly, CIP requires the seller to arrange transportation to the agreed-upon destination. However, the key distinction is the seller’s mandatory insurance coverage under this term. The seller must secure an insurance policy to cover risks during international transit, adding a critical layer of protection for the buyer.

Under CPT, securing insurance is optional and falls on the buyer. In contrast, under CIP, the seller must provide insurance coverage, representing an additional cost incorporated into the transaction price. This added investment offers greater peace of mind for the buyer. Although the buyer assumes responsibility for risks once the goods are handed over to the carrier, the insurance policy ensures coverage during transportation.

Per the International Chamber of Commerce’s 2022 Incoterms update, insurance coverage under CIP must equal at least 110% of the contract value during transit. This additional 10% buffers unforeseen expenses and safeguards against indirect losses (e.g., delays or disruptions due to non-delivery).

The extra margin covered by the insurance compensates for the value of the goods. It provides a financial safety net in case of unexpected costs, ensuring that the buyer is better protected. This makes CIP particularly beneficial for businesses dealing with high-value, sensitive, or time-critical shipments.

Making the Right Choice: CPT or CIP?

Choosing the right Incoterm for your international operation requires a detailed analysis of the contract, delivery point, and specific project conditions. Key factors to consider include:

- What type of transportation does the shipment require?

- What are the transaction costs?

- What risks are associated with the shipment?

- What legal and customs requirements apply to the countries involved?

- What is the logistical capacity of the parties?

Taking these considerations into account, CPT can help reduce the seller’s initial costs. Since the buyer assumes the risk and insurance costs, this Incoterm is often used between experienced trading partners. It is particularly suitable for smaller products—such as electronic components or equipment—that are transported via a single transport mode, reducing the risk margin.

While similar, CIP is recommended when parties prioritize higher protection. For instance, it is ideal for high-value, specialized components or parts—a common scenario in the technology industry. Additionally, as the likelihood of incidents increases, CIP is a better option when the buyer has less experience managing risks or when the shipment involves multiple modes of transportation.

Aerodoc: Your Trusted Logistics Partner for International Operations

In the face of the challenges posed by international trade, partnering with a seasoned IOR provider like Aerodoc—with over 25 years of experience—can pave the way for expansion into new global markets. Operating in 172 countries worldwide, Aerodoc tailors each solution to meet the specific needs of your project.

Through its DDP with IOR (Importer of Record) service, Aerodoc simplifies entry into countries where customers lack a legal entity. Aerodoc also provides end-to-end logistics support, ensuring seamless coordination at every process step.

Discover how far your business can grow with Aerodoc’s expertise. Contact our specialized team.

Q&A

- What are Incoterms CPT and CIP, and how do they compare? Both CPT (Carriage Paid To) and CIP (Carriage and Insurance Paid To) require the seller to organize and pay for transportation to the agreed-upon destination. However, the key difference is insurance: under CPT, the buyer handles insurance, while under CIP, the seller must secure insurance covering at least 110% of the contract value during transit.

- When does the transfer of risk occur in CPT and CIP? In both Incoterms, the risk transfers to the buyer when the goods are handed over to the first carrier. Despite this, CIP includes mandatory insurance coverage during transit, providing additional security for the buyer.

- Which Incoterm is more suitable for high-value or sensitive shipments? CIP is better suited for high-value, sensitive, or time-critical shipments, as it ensures mandatory insurance coverage. It’s ideal for industries like technology, where added protection is crucial.

- In what situations is CPT recommended? CPT is recommended for transactions involving experienced trading partners, smaller products, or lower-risk shipments—such as single-mode transportation of durable goods. It helps reduce the seller’s initial costs by leaving insurance to the buyer.

- What factors should businesses consider when choosing between CPT and CIP? Key factors include transportation type, transaction costs, shipment risks, legal requirements, and the parties’ logistical experience. CIP is preferable for comprehensive protection, while CPT is cost-effective for more straightforward, lower-risk scenarios.