The World Trade Organization has valuation rules for international shipments. Any compliance mistakes in that process can create complex issues. Companies need to have an accurate compliance process in place to prevent delays.

Freight valuation is one of the most critical aspects of international shipments, even more so for high value-added products, as parameters are often modified and valuations may vary widely. A proper compliance process in the country of origin may mean the difference between successful and failed shipments.

‘The compliance process is carried out before shipment. Customers inform us that they are shipping something to a specific destination and ask for a quote,’ explains Estefanía Sisatzky, Aerodoc’s Sr. VP of OPS & Customer Service. ‘We trigger a customs valuation review to declare those goods and make sure they do not get rejected due to undervaluation, dumping or clearance issues.’

As the World Trade Organization (WTO) has set international valuation rules, compliance must be perfect. ‘We need to make sure that the goods we are shipping comply with local regulations, finding out which permits and licenses will be required, and reviewing requirements, mandatory voltages, and labeling rules, among other issues,’ explains Sisatzky.

The WTO’s Customs Valuation Rules

International shipments may present several challenges to all parties involved, like how to estimate a product’s value, as some countries have stricter regulations than others. According to the WTO, ‘this can be as hard for importers as complying with the applicable laws.’

Because of this, the organization created the Agreement on Customs Valuation (ACV), which aims to ‘define fair, uniform and neutral parameters for the valuation of imported goods for Customs purposes, conforming to commercial realities, and outlaws the use of arbitrary or fictitious Customs values, setting a group of valuation rules that expand on and increase the accuracy of the original Customs valuation stipulations.’

To further expand that approach, the leadership of the WTO – the sole international organization in charge of international trade rules – warns that its ‘agreements cover goods, services and intellectual property. They spell out the principles of liberalization, and the permitted exceptions [and] require governments to make their trade policies transparent by notifying the WTO about laws in force and measures adopted.’

Customs Valuation Methods

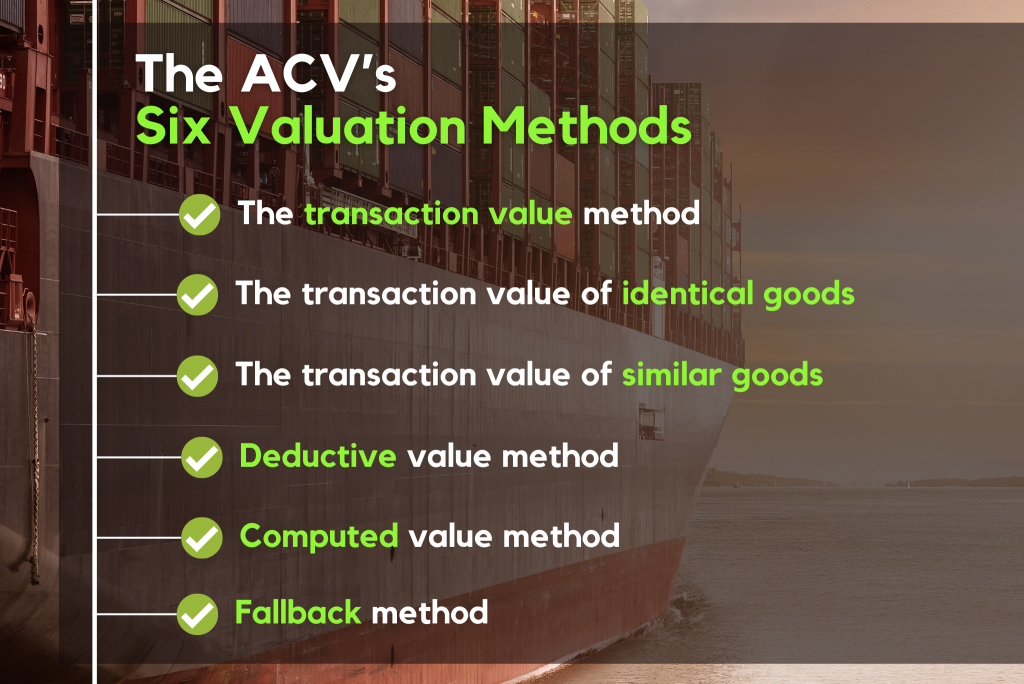

According to the European Commission’s Directorate-General for Taxation and Customs Union (DG TAXUD), ‘the customs value provides the basis for assessment of the customs debt, which is normally calculated as a percentage of the customs value.’ However, there isn’t a single method for assessing that value. The ACV provides six approved methods to reach that number, which follow a hierarchy defined by an official WTO list.

The ACV’s Six Valuation Methods

According to DG TAXUD, ‘the primary valuation method is the transaction value method, which comprises the total amount paid (or to be paid) for the imported goods. The transaction value is subject to certain additions and deductions If the transaction method is not applicable, the other secondary valuation methods would be applied in sequential order.’

The U.S. Customs and Border Protection offers the following hypothetical situation as an example: X Company in Dayton, Ohio pays $2,000 to Y’s Toy Factory in Paris, France for a shipment of toys. The $2,000 consists of $1,850 for the toys and $150 for ocean freight and insurance. Y’s Toy Factory would have charged X Company $2,200 for the toys; however, since Y’s Toy Factory owed X Company $350, Y’s Toy Factory only charged $1,850 for this particular shipment of toys. Assuming the transaction is acceptable, what is the transaction value? The CBP’s answer: $2,200, that is, the sum of the $1,850 plus the $350 indirect payment. Because the transaction value excludes C.I.F. charges, the $150 ocean freight and insurance charge is excluded.

The Importance of Compliance Services

Customs valuation is a complex process that requires experienced professionals to be properly handled. ‘Moreover, if the operation involves countries with heavier regulations, we also add physical inspections, taking photos of the shipment to clear any potential doubts,’ adds Sisatzky.

Shippers must also consider other variables that increase service costs – insurance, weight, and destination. According to Aerodoc’s Sr. VP of OPS & Customer Service, ‘you need all this to estimate tariffs and transit times.’

‘If needed, we also explain how to handle the freight, indicate any modifications needed for invoicing and the declared value, and the estimated transit time,’ says Sisatzky.

To ensure a seamless process, Aerodoc invests in the point of origin, either with physical goods in its Miami hub or by doing pre-compliance documentation work using the data provided by the customer. ‘We do this to prevent or mitigate the risk of undergoing customs inspections, and if they happen, to ensure a quick, solid, and consistent response to customs requirements,’ explains Sisatzky, adding that ‘The more time you spend at the point of origin, the more money you save at the destination.’